A developer’s request to build a new light industrial complex in Coconut Creek’s south-end is back before city commissioners.

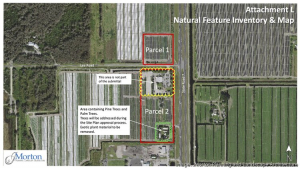

The builder, Greystar, of the proposed 385,000-square-foot complex on the northwest corner of Atlantic Boulevard and Lyons Road is seeking from the city permission to rezone vacant land and allow the construction of the project known as Cocomar.

Commissioners had tabled their requests in July, and Greystar pushed to delay those decisions until Oct. 26.

Many commissioners have said they were concerned about an influx of trucks coming into the city as well as the traffic flow in the area of the planned development.

As part of that, commissioners wanted Greystar to address those issues with city staff, along with nearby residents’ concerns about noise and safety, before they made final decisions on the project.

Commissioners also discussed the consideration of adding a new traffic light at the complex to help control cars and trucks coming in and out of the 36-acre property, where three new buildings are proposed just south of residential areas.

The project is scheduled to be reviewed Thursday, October 26, at the commission meeting which starts at 7 p.m. in the Coconut Creek Government Center at 4800 West Copans Road.

Source: TAPintoCoconutCreek