Bridge Industrial (“Bridge”), a privately-owned, vertically integrated real estate operating company and investment manager, has acquired Pompano Beach Commerce Park — a three-building, 336,852-square-foot industrial campus in Pompano Beach.

Following the acquisition, Bridge plans to launch a comprehensive capital improvements program at the property, inclusive of landscaping, parking lot upgrades, monument signage, and roof replacements. The acquisition will mark Bridge’s first property closing as part of a new value-add strategy.

“The acquisition of this campus in a prime submarket marks not only the latest addition to our growing portfolio, but the introduction of a new value-add strategy that will expand our capabilities and allow us to acquire existing buildings and deliver even more services to our clients in the region,” said Nick Siegel, Partner with Bridge.

Jose Lobon of CBRE National Partners represented the Seller in the transaction.

Located on Powerline Road in the Pompano Beach submarket of Broward County, Pompano Beach Commerce Park is made up of three industrial buildings — spanning 140,094 square feet, 124,894 square feet and 71,864 square feet, respectively. The facilities possess several attractive characteristics including 24-clear heights and multiple points of ingress and egress along its 800 feet of linear frontage along Powerline Road. Bridge has had previous development success in Pompano Beach, with its Bridge Point Powerline Road project spanning over 450,000 square feet less than one mile from its newest acquisition.

The campus is located less than two miles from I-95 and just 1.4 miles from the Florida Turnpike, allowing users to reach nearly all of Florida’s population of 6.2 million within just a 60-minute drive. The property also sits just 15 miles from Port Everglades and the Fort Lauderdale-Hollywood International Airport, and roughly 40 miles from the Port of Miami and Miami International Airport. The central location of the site allows its tenants to service 92% of South Florida’s 6.2 million population within a 60-minute drive time.

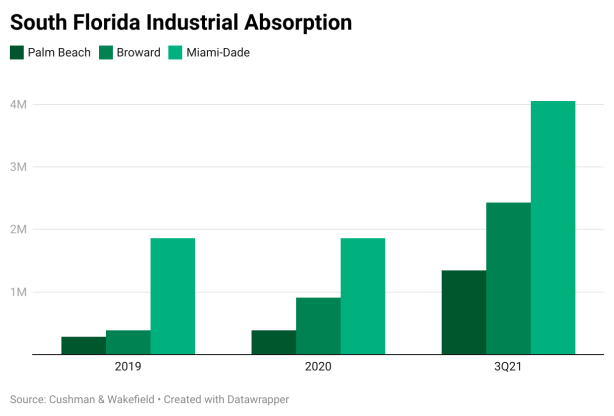

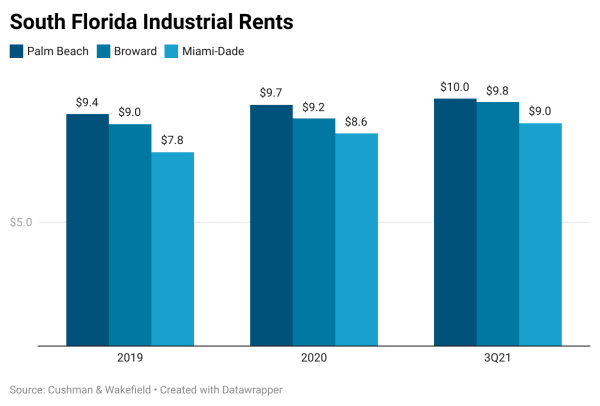

“South Florida is one of the most supply-constrained markets in the entire country, and Bridge has found major success in developing and operating state-of-the-art warehouse space that can help meet the immense demand from industrial users in this area,” said Kevin Carroll, Southeast Partner at Bridge.

Bridge is one of South Florida’s most active industrial real estate developers. The company has acquired approximately 700 acres in 17 separate transactions throughout Miami Dade and Broward Counties and delivered approximately 7 million square feet of Class-A industrial space across the region since entering the market in 2012. The company’s current South Florida portfolio spans more than 5 million square feet of company-owned and third-party managed properties with an additional 2.5 million square feet under construction.

Source: CRE-sources