The nine-acre truck depot in Kearny, New Jersey, wouldn’t appear to fit anyone’s definition of prime real estate.

The site is surrounded by a tangle of major highways that are often clogged with traffic, abuts a rail yard packed with clattering freight cars, and is just down the street from one of the most polluted landfills on the northern New Jersey waterfront.

To Andy Smith, a managing director at Brookfield Asset Management and the global head of its logistics investments, the parcel, located less than 10 miles outside of New York City, was as attractive as any of the top-tier properties his company owns. This past December, Brookfield paid a little more than $67 million to acquire the site at 1100 Newark Turnpike, which it plans to continue to operate as a terminal for trucks.

“I’m not sure if someone driving down the highway would look out and think, ‘Hey, that’s an immaculate truck terminal,'” Smith conceded. “But as crazy as it sounds, it’s fantastic real estate.”

Brookfield’s portfolio is still headlined by blue-chip real-estate assets such as the Manhattan West mixed-use complex in New York City, where major office tenants, like the law firm Skadden Arps, base their operations, and Canary Wharf, a similarly large-scale London property with a mix of office, retail, and residential space. But the development and investment firm, whose global real-estate portfolio includes $260 billion of property, has also amassed about $500 million — and counting — of industrial land sites across the country since 2018.

Brookfield is one of several big-name investors that are paying increasing attention to lowly industrial land. Recent buyers include the financial firm J.P. Morgan Asset Management, the private-equity players Fortress and Cerberus, and real-estate-focused investment giants, including Brookfield and the San Francisco-based firm Stockbridge.

Industrial land is used for a range of purposes, such as parking trucks and buses, storage for bulky equipment like cranes, cherry pickers, and bulldozers, and a place to stage heavy goods that can weather exposure to the elements including gravel, lumber, or shipping containers. The interest in industrial land reflects the growing recognition that these sites are as essential as they are ordinary, providing key infrastructure for the delivery of goods and services to large swaths of America.

Such land has been around for as long as the country has had heavy industry. What’s new is the rush of major investors who see a lucrative opportunity to corporatize a niche of the real-estate market that is still overwhelmingly owned by an array of small businesses and individuals. The segment has even been rechristened with a more sophisticated-sounding moniker: industrial outdoor storage, or IOS.

Investors estimate there’s at least $200 billion of industrial-outdoor-storage land across the country, a sizable enough market for years of investment to come. IOS sites have caught on as an unlikely institutional-caliber asset as other more established areas of the real-estate-investment market, like office buildings and retail space, have been upended by the growing popularity of working from home and online shopping.

There’s A Shrinking Supply Of Industrial Land

Another factor that has helped ignite interest in this unheralded corner of the industrial market is the fact that outdoor-storage sites are a disappearing commodity, driving up rents and their value.

That’s especially true in northern New Jersey (just outside New York City), Los Angeles, the San Francisco Bay Area, Seattle, and other major cities across the country, where land is scarce, populations are large, and transportation infrastructure like highways, cargo ports, rail links, and airports abound. In these places, industrial areas have been whittled down for decades by demand to convert those districts to other uses, such as residential and commercial space.

More recently, a boom of warehouse construction has cut into the already-shrinking pool of outdoor-storage land. A record 446 million square feet of warehouse space was finished last year across the country, according to CBRE. The huge volume of new warehouse development has not only thinned the number of remaining outdoor-storage sites, but also created additional demand for it.

“Many warehouses just weren’t designed for the parking, storage, and staging requirements that come from the enormous throughput of goods traveling in these spaces today and the speed at which they’re moving,” said Matthew Pfeiffer, a managing partner at Alterra Property Group, which invests in IOS sites. “That has created increased demand for outdoor-storage needs that benefits us.”

Pfeiffer, for instance, said that Alterra, which was founded in 2017 in Philadelphia, is in the process of negotiating a lease for an 11-acre site in South Florida next to a new warehouse that was recently leased by a large shipping and logistics company. The shipping and logistics company, he said, realized its warehouse operations will require additional parking capacity on Alterra’s site. Pfeiffer said he couldn’t yet disclose the details of that transaction, including the location of the parcel or the identity of the players involved, because the deal is ongoing.

Investment In Industrial Is Just Taking Off

Buyers of these parcels see a supply-and-demand imbalance that is likely to persist and generate profits for years to come.

“There’s only so much land that’s zoned for industrial uses,” said Dan Haroun, who cofounded the Manhattan-based IOS investment firm Catalyst Investment Partners in 2021. “And these municipalities aren’t going to create more of it.”

Outdoor-storage sites are different from many other real-estate assets in that they need little in the way of capital upgrades and maintenance to prevent them from becoming obsolete. Industrial land also generally has lower operating costs and taxes compared to other real estate.

Haroun said tenants pay a wide range of rents that often depend on the specific attributes and location of a site. IOS space can cost just a few thousand dollars per acre per month in smaller markets, he said, up to $60,000-$70,000 for well located sites in large, space constrained urban areas.

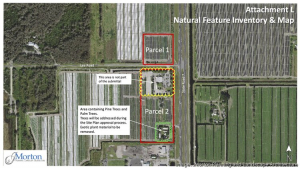

IOS sites are not always completely vacant, but are generally defined as having 30% or less of their land area covered by a building or structure. Brookfield’s Kearny truck terminal, for instance, has abundant parking, but also a long, narrow building that allows goods to be unloaded and transferred between truck trailers.

It’s Hard To Find Big Enough Portfolios Of Industrial Land

There are challenges, too, in breaking into the business of owning industrial land.

Unlike Brookfield’s transaction, most IOS sites are under $10 million, investors said, making it work-intensive to amass portfolios of the dollar scale substantial enough to attract institutional capital.

Fortress has compensated for that by acquiring properties at a rapid rate, purchasing 80 properties in the past 18 months, “one of the fastest acquisition pipelines in the IOS market,” said Greg Pearson, a managing director at the firm who helps manage its IOS acquisitions. The investment firm has bought roughly $1 billion of outdoor-storage sites over the past two years in Los Angeles, the San Francisco Bay Area, and Seattle. Pearson said he expects the firm to “remain active,” buying up more IOS land in the coming year.

Others have found ways to buy at scale. Alterra, for instance, closed on an $86 million purchase of 14 outdoor-storage sites in December that were sold by the trucking company Heniff, which plans to continue to lease and occupy the properties. But Alterra has also built up its capacity to handle a larger volume of smaller IOS deals. The 75-person firm now has a 20-person investment team dedicated to IOS alone. It raised a $500 million fund for IOS investment in 2021 and is in the process of launching a follow-up vehicle that will be larger in size.

Catalyst, with a 10-person team, raised a $55 million fund in 2021 and is now raising a second fund that will be about $130 million, Haroun said. While the first fund was made up of mainly high-net-worth investors, the second will have larger-sized contributors, such as “pension funds and endowments,” Haroun said, a sign of the growing eagerness among institutional investors to partner with specialists who focus on IOS and can manage the transactional volume.

Zenith IOS, another outdoor-storage-investment firm that’s based in Brooklyn, struck a $550 million joint-venture deal with J.P. Morgan Asset Management in 2021 and is in the process of deploying that capital. So far it’s spent about $350 million of that and this year plans to use the remaining $200 million. Combined with financing, it expects to purchase roughly $600 million worth of IOS deals this year, Benjamin Atkins, the firm’s CEO and cofounder, said.

Atkins said he has been impressed by the robustness of the IOS market, even with fears about the broader economy. Zenith is currently in negotiations, for instance, to lease 8280 NW 80th Street, a three-acre site it purchased last summer in Miami for $9.1 million, to a logistics company that would use it for storage and vehicle parking.

“We’ve been looking for signs of weakness as other areas of commercial real estate slow down, but in IOS we’re not seeing it,” Atkins told Insider.

Zenith has such an appetite to expand its industrial-outdoor-storage portfolio that Atkins used Prologis, one of the world’s largest owners of warehouse space, as a benchmark for his ambitions.

“We want to be the Prologis of dirt,” Atkins said.

Source: Business Insider