Following a year marked by a contentious presidential election and likely changes to come in U.S. policy prescriptions, law firm leaders in Florida are largely optimistic about their firms going into 2017 and expect to see growth in Miami, according to a recent survey of firm leaders and administrators in the region.

“We’re more optimistic today in light of the election,” said Holland & Knight managing partner Steven Sonberg, discussing his personal outlook on the year to come. “The economy was in pretty good shape, and it seems clear with Donald Trump as president, he intends to add fuel to the economy.”

Sonberg isn’t the only firm leader in Florida looking forward to the coming year, according to ALM Intelligence’s Law Firm Leaders survey, which collected responses from administrators and leaders from 56 law firms in the Miami region. The survey was completed in September and October, before Trump’s victory.

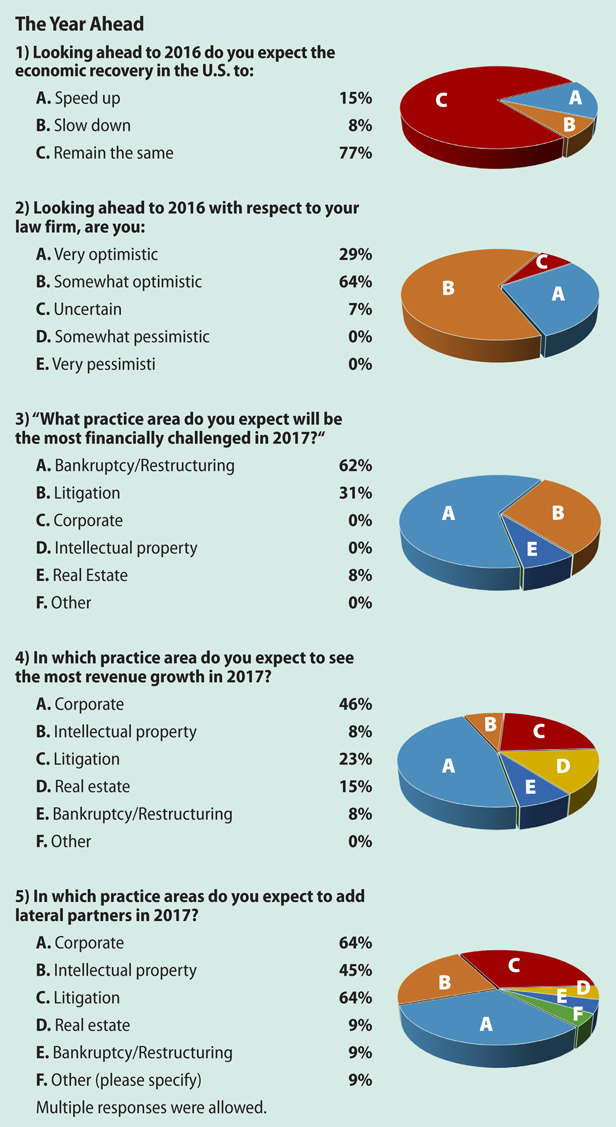

In the survey, 29 percent of respondents said they were very optimistic about their firm’s prospects in 2017, while another 64 percent said they were somewhat optimistic. Seven percent said they were uncertain about the coming year, while no firm leaders said they were pessimistic about 2017. The survey also showed that 69 percent of firm leaders in Florida expect deal flow in 2017 to increase moderately over 2016, with another 8 percent expecting a significant increase. While no firm leaders expected deal flow to decrease, 23 percent said that they anticipated flat growth.

The greatest percentage of respondents, 46 percent, said they would expect to see corporate work provide the most revenue growth next year, with litigation as the second most popular response, at 23 percent. Fifteen percent said that they expect to see the most growth in real estate, while 8 percent selected bankruptcy and intellectual property.

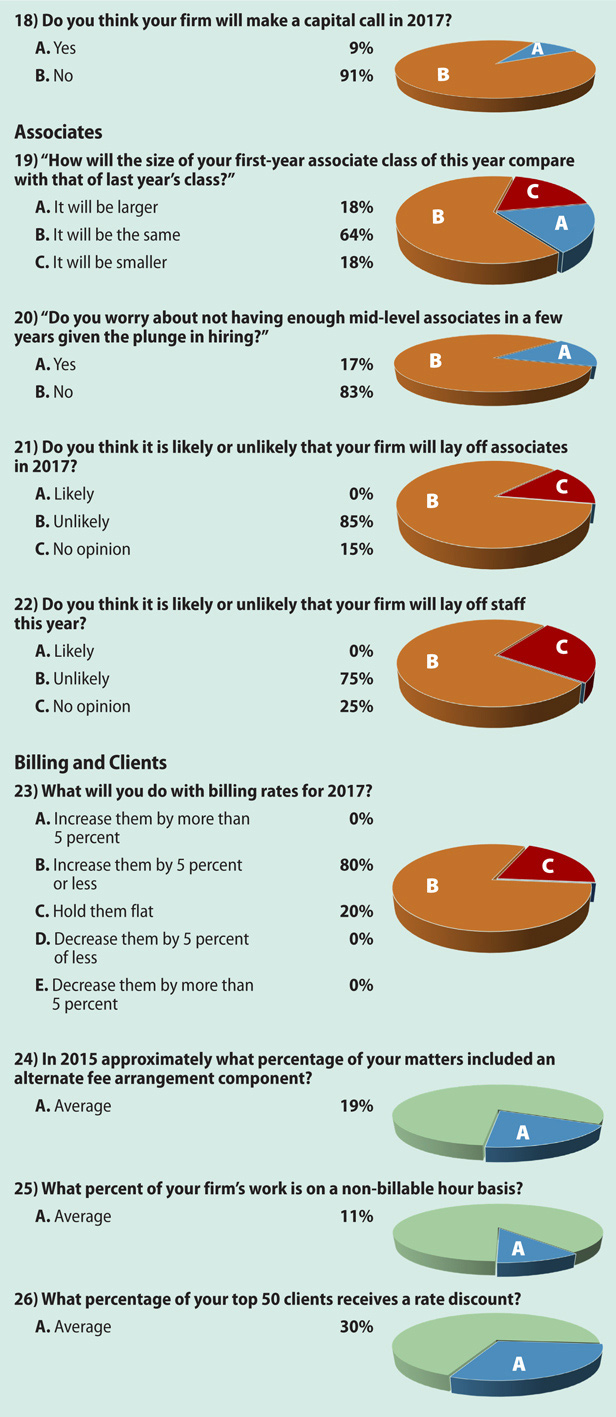

Meanwhile, 62 percent of respondents said that they expected bankruptcy and restructuring to be the most financially challenging practice area in 2017. Litigation was named as the most potentially challenging by 31 percent of firm leaders, and another 8 percent pointed to real estate as an expected challenge. A large majority, 80 percent, of respondents said they expected their firms’ billing rates to increase by 5 percent or less in 2017, with the other 20 percent saying they plan to keep their rates at 2016 levels.

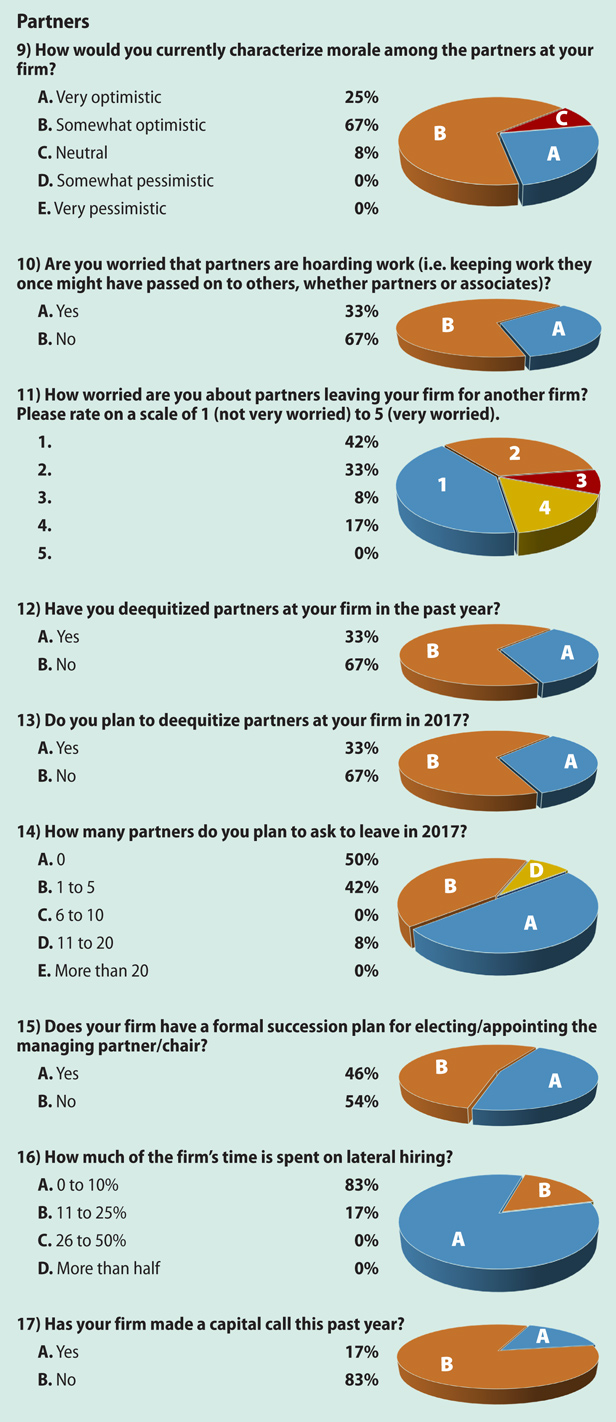

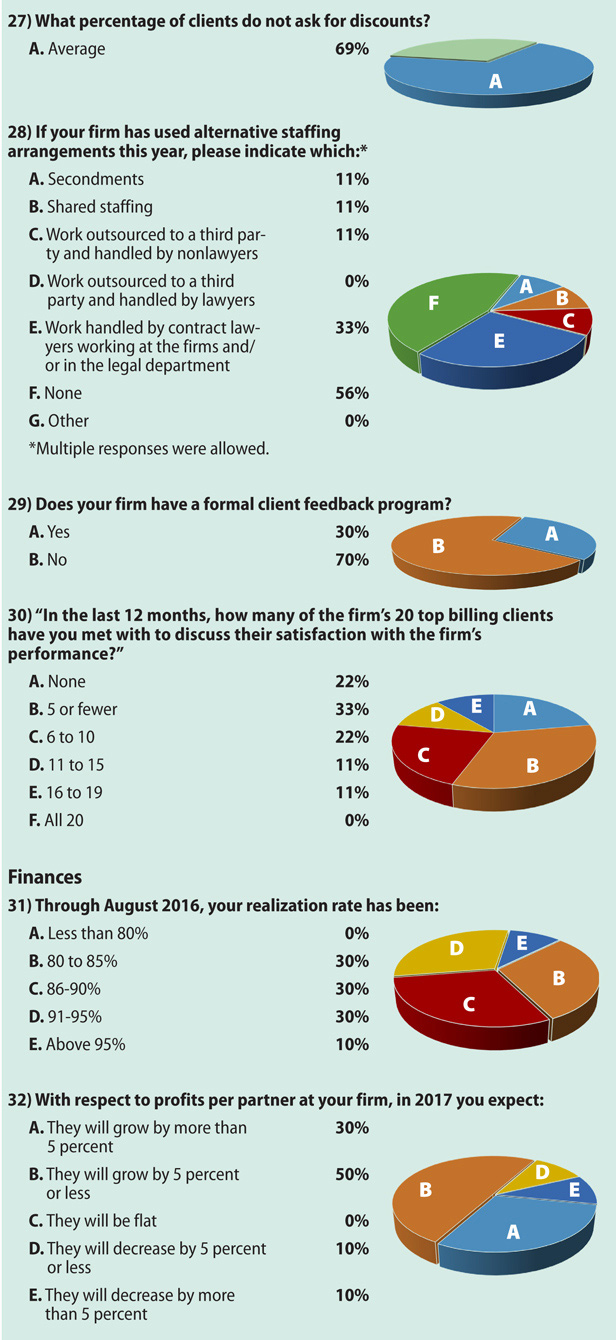

Firm leaders were also generally bullish on their firms’ financial outlook for 2017 in terms of the amount of profits taken home by partners. While 20 percent of respondents said they would expect profits-per-partner to decrease, the remainder said they anticipated increases—50 percent said they expect partner profits to grow by 5 percent or less, while 30 percent expected growth of more than 5 percent.

National Comparison

For the most part, the outlook among firm leaders in the Miami regional market closely tracks those of firm leaders in a nationwide survey also conducted by ALM Intelligence. But there were some differences in few key areas—including firm leaders’ optimism about their own firm’s prospects, the likelihood of an increase in deal flow and revenue growth from corporate work in 2017.

Compared to a nationwide survey, which included responses from 103 law firm leaders, a higher percentage of firm leaders in Florida were very optimistic about their own firm’s prospects in the coming year, and a greater percentage of those in the Miami region were more likely to expect increased deal flow and revenue growth from corporate work.

Discussing the results of the nationwide survey with DBR affiliate The American Lawyer, legal consultant Kent Zimmermann of the Zeughauser Group suggested that a change in presidential administration may have some impact on the mix of practice areas providing the most revenue growth for firms. Both the nationwide and regional surveys were conducted in September and October, before the election.

As specific examples, Zimmermann noted that, depending on the policy choices of President-elect Donald Trump, law firms could see more international trade, regulatory and tax work.

“Generally, change in Washington has historically been good for law firms,” Zimmermann told The American Lawyer, “but this particular change will be a mixed bag for law firms, and there will be ups and downs.”

Nationwide, 32 percent of firm leaders said they expected to see the most revenue growth from corporate work, while 27 percent pointed to litigation as the most likely revenue growth driver in 2017. In the Miami region, by contrast, 46 percent of firm leaders selected corporate work as the area that would see the most revenue growth, while only 23 percent said they expected litigation to see the most growth in 2017.

Holland & Knight operations and finance partner Douglas Wright also described likely policy changes in a Trump administration as an opportunity for more legal work in certain areas—the president-elect has, for instance, promised to focus on infrastructure projects and has expressed an interest in overhauling the U.S. tax code.

“I think it’s likely that the tax code is overhauled,” said Wright. “And that really hasn’t happened since 1986, so I think those changes … will require businesses and individuals to reevaluate their structure and business planning.”

Firm Expansion

The nationwide and regional outlook on real estate practices also had some slight differences—10 percent of firm leaders in the national survey said they would expect to see the most growth in their real estate practices; in the Miami regional results, 15 percent of firm leaders said they expect real estate to be the practice with the most growth next year.

Sonberg expects his firm’s real estate work to continue at a high level. That’s especially true in Florida, he said, where real estate developers are remaking the landscape around Miami by eyeing potential projects in Broward and Palm Beach counties. He and his colleague, Wright, also noted an ambitious plan by Tampa Bay Lightning owner Jeff Vinik to develop an area in downtown Tampa.

GrayRobinson President Mayanne Downs had a similar take, saying that in light of increased real estate development, she’s seen a high demand for legal work in the realms of land use, permitting, planning and zoning. She also noted she’s starting to see an uptick in construction-related litigation that’s followed some of the real estate development in the state in the recent past.

“Real estate transactions are up,” Downs said, “and with that, all the stuff that goes with it.”

Law firms themselves have their own real estate and expansion plans. Downs noted GrayRobinson has a relatively new office location in Miami after relocating in 2015 to the downtown Wells Fargo Center. And Sonberg said Holland & Knight plans to add a sixth floor to its lease in the South Florida hub city.

Those developments appear to align with the survey results—83 percent of firm leaders in Florida said they expect to add lateral partners in Miami next year. The next most popular responses were New York, where 33 percent of firm leaders said they expect to hire laterals, and in Los Angeles and Chicago, where 17 percent said they expect to add to their partner ranks.

Overall, 72 percent of survey respondents said they would expect in 2017 to increase their firms’ total head count by 1 to 5 percent, while 14 percent anticipated more growth of 6 to10 percent. The remaining 14 percent of firm leaders said they expected to keep their lawyer head count the same in 2017 as it was in 2016.

Downs, for her part, said she’s focusing on hiring in Miami, but she also stressed that she’s engaged in a lot of recruiting throughout many of GrayRobinson‘s offices in Florida.

“Miami is buzzing. … It’s almost as if there’s an electric hum in the air,” she said. “So Miami for sure. But I really am seeing the excitement around the state.”

Source: DBR