South Florida’s industrial market ended the fourth quarter of last year with a seismic shift in ownership of 1.4 million square feet in Miami-Dade and Broward counties.

Boston-based Longpoint Partners acquired 25 industrial buildings in eight cities from Conshohocken, Pennsylvania-based Seagis. Longpoint’s $262 million portfolio purchase clocked in as the priciest industrial deal of 2023 — a sign that South Florida warehouses remain a top target for institutional investors.

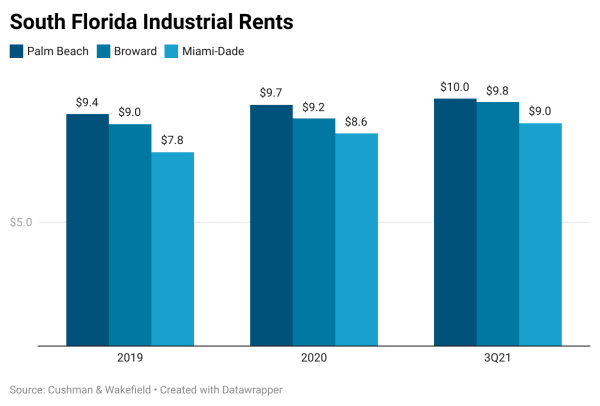

Industrial properties arguably represent a safe bet, given historically low single-digit vacancy rates and a continuing trend of rising asking rents, according to a recent CBRE report.

The tri-county region experienced a slight uptick in empty warehouse spaces in the fourth quarter, even though tenant demand remains high — except in Broward. Still, industrial landlords kept increasing asking rents, the report shows.

Miami-Dade County

In the fourth quarter, the vacancy rate rose to 3.2 percent, compared to 2.6 percent during the same period of 2022, CBRE found. The average asking rent rose to $15.50 a square foot from $15.05 a square foot in the third quarter. It also increased by nearly 16 percent compared to $13.37 a square foot during the fourth quarter of 2022.

Miami-Dade’s slight increase in vacancies was due to nearly 5.4 million square feet of new industrial space becoming available last year, the report states. About 80 percent has been leased to date.

San Francisco-based Prologis scored one of the biggest industrial lease signings of the fourth quarter. Packing and shipping firm Ameriworld Fulfillment signed a new 10-year lease valued at $25.2 million for 124,000 square feet in an industrial complex near Miami International Airport owned by Prologis.

Broward County

The vacancy rate in Broward remained relatively unchanged, hitting 3.5 percent in the fourth quarter, compared to 3.7 percent during the same period of 2022, CBRE found. The average asking rent jumped by 20 cents to $15.65 a square foot, compared to $15.45 a square foot during the third quarter of last year. It also increased by roughly 11 percent compared to $14.14 a square foot during the fourth quarter of 2022.

During the second half of last year, tenant demand was relatively weak in Broward, but the county has a limited supply of industrial space, which led to the average asking rent increasing, the report states.

In October, All Glass Production signed the second biggest industrial lease of 2023. The glass manufacturing company leased a nearly 250,000-square-foot warehouse at South Florida Logistics Center in Pembroke Pines. The property is owned by Denver-based Sagard Real Estate.

Palm Beach County

Palm Beach County experienced the largest increase in available space, with the vacancy rate hitting 4.2 percent in the fourth quarter, compared to 2.3 percent during the same period of 2022, the CBRE report shows.

The average asking rent rose by 25 cents to $15.75 a square foot, compared to $15.50 a square foot in the third quarter. It also increased by 7.5 percent compared to $14.65 a square foot during the fourth quarter of 2022.

Palm Beach County’s industrial sector experienced a gradual slowdown last year, with vacancies rising during four consecutive quarters, CBRE found.

Bush Brothers Provision Company, a meat packing and distribution company, signed a lease to move its headquarters into a 42,100-square-foot space at Royal Palm Logistics Center, a new industrial project in Royal Palm Beach developed by Orlando-based McCraney Property Company.

Source: The Real Deal