The owner of Bedner’s Farm Fresh Market, a popular agricultural attraction, has proposed rezoning part of its land west of Boynton Beach for industrial development.

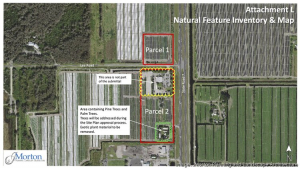

Bedner’s Farm Fresh Market has proposed industrial rezoning on the two parcels outlined in red in Palm Beach County.

(IMAGE CREDIT: JMORTON PLANNING AND LANDSCAPE ARCHITECTURE)

Bedner Brothers Farms, managed by Stephen Bedner, filed a land use amendment with Palm Beach County officials concerning 14 acres of the 19-acre site at 10066 Lee Road, on the west side of U.S. 441.

The Bedner family proposed changing the zoning of the strawberry and pumpkin fields from agricultural to commerce/light industrial, which would allow up to 274,428 square feet of industrial uses. That could include warehouses, flex office/warehouse or self-storage facilities. However, the five-acre site including the farmer’s market would be preserved through a conservation easement.

The land use amendment will require County Commission approval. A hearing before the board is tentatively scheduled for Nov. 1.

Source: SFBJ