National industrial in-place rents increased by 7.6% year-over-year to an average of $7.74 per square foot in January as the industrial new supply pipeline undergoes a rebalancing, according to CommercialEdge’s February Industrial Report.

The national vacancy rate rose 20 bps month-over-month to 4.8% as nationwide, an increase of 80 basis points over the last 12 months.

Nearly 425 million square feet of industrial space was under construction. New deliveries are forecast to decline in coming years, according to CommercialEdge.

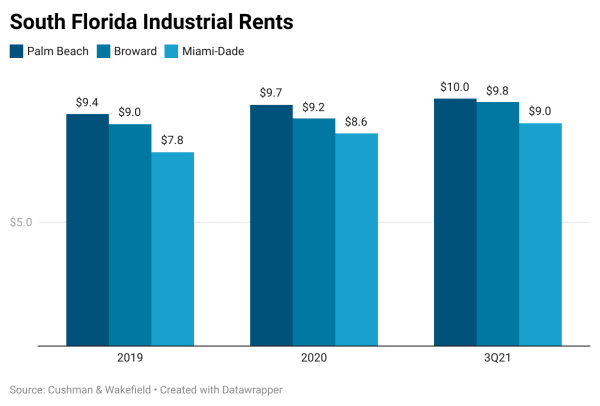

Industrial transactions totaled $2.6 billion through January, at an average sale price of $145 per square foot. The top market for rent growth remained the Inland Empire, with average rents rising 12.9% year-over-year in January and Miami experienced the third-highest rent growth in the country, reaching 11.4% as of January.

The sales volume leader at the start of this year was Chicago and Philadelphia led the Northeast in development, with 7.8 million square feet underway as of January.

“The influx of new supply contributed to keeping the growth of sales prices in check,” Commerical Edge’s Evelyn Jozsa writes. “This comes after more than 1.1 billion square feet of new industrial space (5.7% of the stock) has been completed since the start of 2022, a rate which wasn’t sustainable over the long run. This has helped ease the pressure in some industrial markets that were experiencing extremely tight vacancies coming out of the pandemic.”

The national vacancy rate currently sits at 4.8%, an increase of 80 basis points over the last 12 months. New industrial starts in 2023 totaled 314.6 million square feet, down significantly from the 593.2 million square feet in 2022 and the 557.4 million square feet in 2021.

“Stabilizing construction deliveries and start volume are healthy market responses to what has been happening over the last three years,” according to Peter Kolaczynski, Director, CommercialEdge. “We believe demand will remain strong, allowing for a boost in construction starts over the next few years.”

After the robust previous two years, the main drivers of this current cooling were interest rate increases, general economic uncertainty, and banks pulling back on construction loans.

Commercial Edge forecasts that construction starts should pick up again once interest rates come down and the industrial sector has had time to fully reckon with the impact of historic levels of new development.

“Rent growth will cool this year as demand for industrial space continues to wane and the record level of new supply delivered over the last two years becomes fully absorbed,” Jozsa writes.

Long-term, rent growth should remain solid even amid headwinds faced by the sector, according to the report.

Source: GlobeSt.