Bethesda Hospital East could sell a Boynton Beach office complex to an industrial developer.

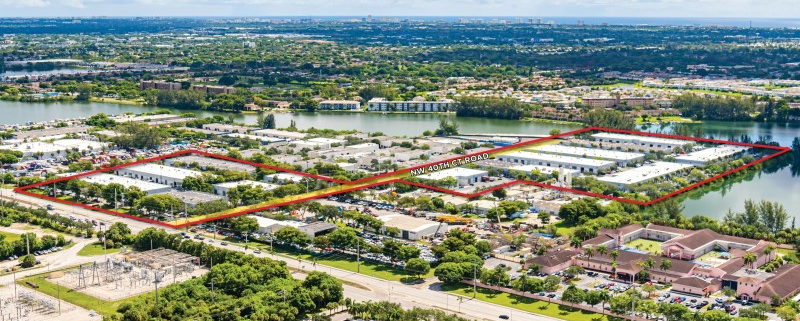

The City Commission will consider a new site plan with a distribution center for the 30.7-acre property at 3800 S. Congress Ave. on Feb. 6. It’s owned by the hospital, which is part of Miami-based nonprofit Baptist Health South Florida.

The property currently has a 125,281-square-foot office/medical office complex that’s home to multiple tenants, including Bethesda Hospital’s Women’s Health Service and the Bethesda College of Health Sciences, which is also part of the hospital. The facility was built in 1970.

Under the new site plan, the property would be redeveloped by Orlando-based Foundry Commercial with two warehouses for a combined 457,026 square feet. The developer is seeking a waiver to reduce the amount of parking from the standard requirement of 914 spaces to 462 spaces. There would be 20 electric vehicle chargers. Foundry has the Boynton Beach site listed on its website under the name Bethesda Industrial Center.

The site plan by Boca Raton-based Arcadis shows warehouses of 223,249 and 233,777 square feet, each with 32-foot clear height.

Source: SFBJ