Most CRE Executives ‘Bullish’ For 2021

The COVID-19 vaccine rollout and an abundance of capital looking for deals are the top reasons why 74 percent of commercial real estate executives said they were optimistic about the CRE market and overall economy over the next 12 months, according to the results of the annual State of the Market Survey released today by international law firm DLA Piper in conjunction with its 16th Global Real Estate Summit.

The 2021 survey was conducted in February and March after Americans had elected a new president and vaccines were being distributed leading to a significant increase in optimism compared to 2020 results. By comparison, the 2020 survey was conducted in August and September with results released in October. At that time, the U.S. was in the midst of a contentious presidential election and it was still unknown when vaccines would actually be available.

“We were happy to see the positive shift in sentiment from our 2020 survey taken in the early fall of last year,” said Barbara Trachtenberg, co-vice chair of DLA Piper’s U.S. Real Estate Practice and co-author of the report.

Trachtenberg said there had been “a lot of uncertainty when we conducted the 2020 survey. A lot of that seems to have settled.”

When asked the primary reason for their confidence about the CRE market for the next 12 months, 41 percent of the respondents cited “continued rollout of COVID-19 vaccines”; 35 percent cited “abundance of capital still chasing deals”; and 18 percent pointed to the “U.S. economic outlook.”

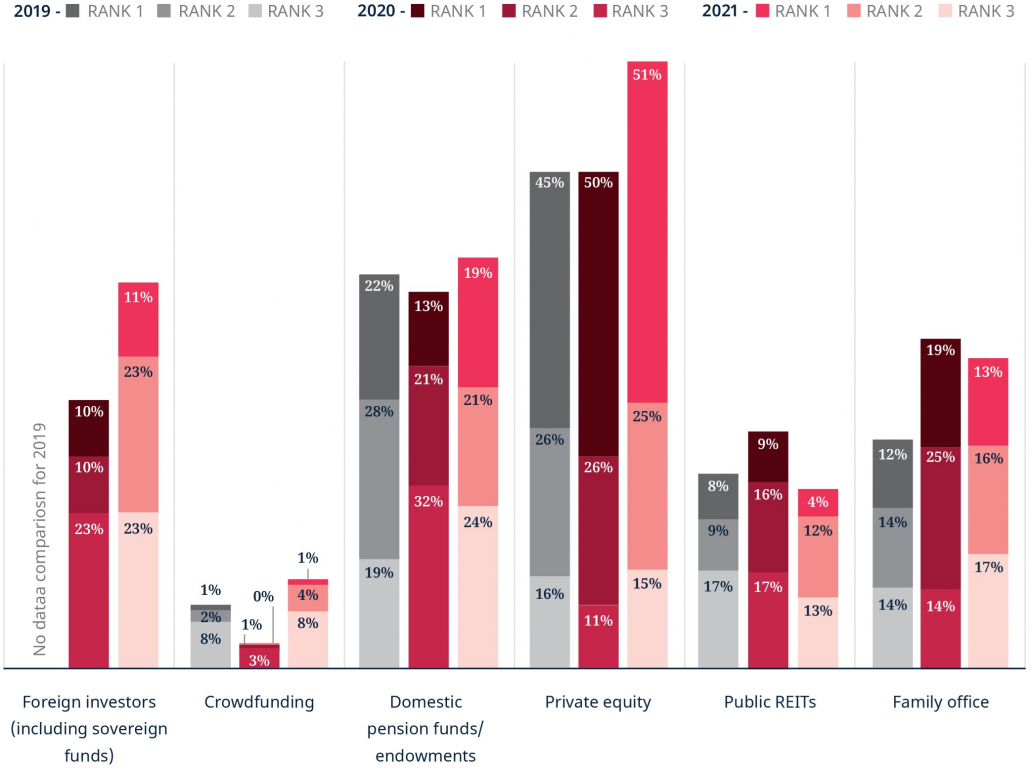

The report noted “a significant amount of capital is expected to hit the CRE investment market in 2021 as more than US$200 billion sat on the sidelines in 2020 waiting out the uncertainty.”

Much of that capital is likely to be invested in the logistics and warehousing and the life science/biotech sectors, which were called “bright spots for the industry.”

When asked which asset classes present the most attractive risk-adjusted opportunity in the U.S. during the next 12 months, 61 percent chose logistics and warehousing and 57 percent selected life science/biotech. Multifamily (49 percent); data centers (44 percent); medical office (37 percent); cold storage (36 percent); industrial, excluding logistics and warehousing (33 percent); affordable housing (32 percent); senior housing (25 percent); and hotels/lodging (22 percent) rounded out the top 10.

The report found multifamily housing has almost completely returned to 2019 survey levels, down only 1 percentage point and up significantly from the 2020 survey when only 35 percent of respondents considered multifamily an attractive investment.

Trachtenberg said the results for logistics and warehousing, life science/biotech and multifamily were consistent with the activity DLA Piper has been seeing in transactions it has handled in the fourth quarter of 2020 and the first quarter of this year.

REMOTE WORKING IMPACTS

While respondents were enthusiastic about returning to the workplace, with 60 percent anticipating about three in four office workers will be back in their offices full time 12 months from now, there are still major concerns about lingering impacts of the pandemic on the office sector.

Eighty-six percent of the respondents believe remote working and work-from-home will continue to impact the commercial real estate market for the next 12 months. Fifty-eight percent of responders believe there will be an increase in the number of office workers who spend less than 50 percent of their working time in office buildings. Eighty-four percent anticipate it will take at least two years for U.S. office building vacancy to return to pre-pandemic levels and 46 percent said it will take more than three years.

That may be part of the low scores for both suburban office (13 percent) and downtown office (11 percent) as an attractive asset class for the next 12 months. The report noted the interest in suburban office, which had hit 21 percent in the 2020 survey, may have been a temporary surge last year.

HOT MARKETS

The survey found the largest cities, including New York City, Los Angeles, San Francisco and Washington, D.C., continued to see a decrease in attractiveness to investors, likely due to impacts of the pandemic. Washington, D.C., for example, had decreased by 8 percentage points from the 2020 survey. But Trachtenberg warned not to count out major cities so quickly.

“For stable cities like New York, I think they are going to rebound. They always have. They always will,” she said.

Much of the investor activity has been focused on secondary cities, a trend Trachtenberg noted had begun before the pandemic hit and accelerated during the past year.

Austin, Texas, maintains its status as the No. 1 city in the U.S. for investment during the next 12 months at 53 percent, up 4 percentage points from the 2020 survey. Nashville, Tenn., holds second place again, with 46 percent.

Forty percent of respondents selected Raleigh-Durham in North Carolina as attractive investment locations and Denver and Charlotte, N.C., both had 32 percent of respondents picking them. Phoenix and Miami also increased in popularity from the 2020 survey, up 11 percentage points and 17 percentage points, respectively. The report noted Tampa, Fla., was the most common write-in answer as a “sleeper city,” followed by Salt Lake City and Charleston, S.C.

“Clearly there is a lot of interest among commercial real estate investors in being in those ‘second-tier cities’ that are really now topping the list of where people want to be investing,” Trachtenberg said.

Source: Commercial Property Executive