Amid signs the economy is strong overall — until last week, the stock market was reaching new peaks — boat retailers are anticipating a wave of new buyers.

And with two important boat shows coming to South Florida this week, there’ll be more good news for South Florida’s boating community — fishermen, recreational boaters, or anyone else who benefits from the approximately $11.5 billion that the industry generates for the region.

Boats made in South Florida will be featured among the top-of-the-line vessels from other parts of the country at the 2018 Progressive Insurance Miami International Boat Show and the Miami Yacht Show 2018. Popular center-console fishing boats on display in the water and on land at Virginia Key include models from SeaHunter Boats of Princeton, Doral-based SeaVee Boats, Dusky Marine of Dania Beach and Contender Boats of Homestead, as well as newcomer Streamline Boats of Opa-locka.

Cigarette Racing Team of Opa-locka, whose name is synonymous with high-performance powerboats, will introduce a couple of new models at the Miami Boat Show. Other popular brands on display include Sea Ray, Beneteau, Boston Whaler, MasterCraft, Regulator, Hatteras, Viking and Zodiac.

Denison Yacht Sales, which is headquartered in Fort Lauderdale, has 27 boats at the Miami Yacht Show along Collins Avenue in Miami Beach, including the GT50 by Beneteau, which is making its U.S. debut, and the 45 Express Bridge from Hatteras. Fort Lauderdale yacht brokerage G Marine has the new Spanish-made Astondoa 80 Flybridge.

If sales are strong, South Florida will also see an increased benefit from the shows.

A study by Thomas J. Murray & Associates, Inc., in conjunction with the University of Florida, released in 2017 showed that the Miami Boat Show alone has an annual economic impact of $854.2 million, which is more than twice what a Super Bowl generates. That impact includes approximately $350 million in sales of marine products at the show.

“The economy seems to be treating people very well, so we’re looking to be growing and expanding,” said Jordan DeLong, the director of marketing for Contender Boats, which has at least a dozen of its models on land and in the water at the Miami show. “The show’s going to be good to us, I’m sure of it.”

260,000 – The number of new powerboats that were sold in 2017, says the National Marine Manufacturers Association, which puts on the Miami Boat Show. That’s an increase of 6 percent over the previous year, which marked the sixth consecutive year of growth.

“Things are going quite well. The key is we’re always pushing the bar, trying to go higher and higher and higher,” said Skip Braver, the owner and CEO of Cigarette Racing Team, which will have its new 42-foot GTO Reserve and GTR Reserve at Virginia Key. “We’re firm believers that Miami is one of our best sales tools. There’s only one Miami. We take the magic of our city and the magic of our boats and we blend them together.”

Figures from the National Marine Manufacturers Association, which puts on the Miami Boat Show, back up this rosy view. The organization, which represents the country’s recreational boat, engine and marine accessory manufacturers, says that 260,000 new powerboats were sold in 2017 — an increase of 6 percent over the previous year, which marked the sixth consecutive year of growth. Compare that to the depths of the country’s economic downturn a decade ago, when the number of new powerboats sold in 2009 decreased 24 percent to 153,550.

The most current numbers have Florida leading the country in sales of new powerboats, engines, trailers and accessories in 2016 at $2.5 billion, up 5 percent over 2015. Florida was followed by Texas at $1.4 billion, Michigan ($868 million), Minnesota ($710 million) and North Carolina ($689 million).

“On the horizon, if economic indicators remain favorable to the recreational boating market with strong consumer confidence, a healthy housing market, rising disposable income and consumer spending, and historically low interest rates, the outlook is good for boat sales,” said NMMA president Thom Dammrich.

Chuck Collins, the executive director of another industry organization, echoes this view.

“The price of fuel is still cheap, the price of money is still cheap. Interest rates are low. Every single thing is positive,” said Collins, who heads the Marine Industries Association of Palm Beach County.

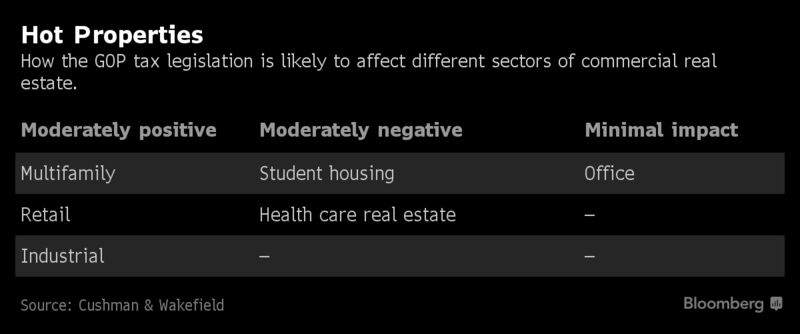

The boating industry’s outlook is even brighter factoring in the new tax legislation approved by Congress at the end of 2017, many say.

“I think it’s really positive given what happened federally to make U.S. business more competitive,” said Phil Purcell, the executive director of the Marine Industries Association of South Florida, which has more than 500 members in Broward, Miami-Dade and Palm Beach counties and supports 136,000 marine-related jobs. “The feedback I’m getting from our members is now they can put some money back into infrastructure and they have the ability to make five-year plans and three-year plans.”

The climate also is good for sales of big boats said Bob Denison of Denison Yacht Sales, which has 20 offices ranging from Miami Beach, Naples and Montauk, N.Y., to Seattle, San Diego, Puerto Rico and St. Thomas in the U.S. Virgin Islands.

“This year’s Miami Yacht Show is expected to be a solid one. Consumer confidence is near 20-year highs, the stock market is going through the roof and other metrics in housing and employment are strong,” Denison said last month. “More than that, there’s going to be a lot of cool boats on the docks.”

Because of the robust economy, says Nautical Ventures CEO Roger Moore, more South Florida residents will get into boating or upgrade their boats or move into bigger boats.

“We’re extremely optimistic about 2018,” said Moore, whose company has stores in Dania Beach and Palm Beach County that sell everything from standup paddleboards and kayaks to inflatables, center consoles and cruisers, and which has displays at both boat shows this week.

$2.5 Billion – The sales of new powerboats, engines, trailers and accessories in 2016 in Florida, which is No. 1 out of all states in this category. That figure is up 5 percent over 2015..

For many years, people were conservative in their spending, he said, “so they’re looking for an excuse to do something fun, and I hope it’s boating.” Another factor that could boost boat show sales is the damage done by Hurricane Irma in September.

“The hurricane destroyed a lot of boats,” Collins said. “These people are getting their insurance checks, they’re not going to give up boating just because their boat got destroyed. Boats that didn’t get destroyed are going to get repaired.”

Michael Brown, who grew up in his family’s boating business and is the vice president of Dusky Marine in Dania Beach, says those in the market for a new boat are looking at bigger models with bigger motors and more features.

“‘More everything’ seems to be selling,” said Brown, who will have Dusky’s 28- and 33-footers at the Miami Boat Show. “More power, more electronics, more toys, more cup holders. “The cost of fuel’s gone up a little bit, but outboard motors are a lot more efficient. Instead of two 115-horsepower motors, people are buying a pair of 175s. Instead of a single 225 on my 25-footer, which runs great, now it’s a 350. The difference in price is about $7,000 and the fuel economy is almost the same. People no longer want to run at 40 mph, they want 50 or 60 mph.”

SeaHunter Boats of Princeton will formally introduce its new Floridian 28 at the Miami Boat Show. Since word got out about the 28-foot, 5-inch boat, which is designed to fish inshore and offshore, the company can’t build them fast enough.

“It’s something we’re really pushing,” marketing director Isabel Rubio said. “We’re actually on back order right now.”

The Floridian features a higher freeboard that makes it safe to fish offshore. Power options range from a single 350-horsepower outboard motor to twin 350s, which produce a top speed of 70 mph for the 28-foot center console.

Two relatively new local boat builders, Angler Pro Boats and Streamline Boats, both of Opa-locka, hope to take advantage of the healthy economy.

Pedro “Pete” Garcia started Streamline Boats less than a year ago. Garcia, 32, has held about every job in the boating industry. His career began in 2003, straight out of Coral Shores High School in Tavernier. He worked for Regulator, Hydra-Sports and SeaHunter and also started his own boat service company. When his friends Lazaro Hernandez and Luis Blanco offered to partner in a boat company with Garcia.

“They presented me with an opportunity I couldn’t turn down. I decided it was my turn to do my own thing, said Garcia. “My parents said, ‘This is what you’re going to do? Go for it!’ They’ve given me 100 percent support.”

Streamline currently makes a 26-foot center console with a stepped hull in a tournament edition and a sport model. Garcia says he should have a 34-footer available in three or four months. Every boat is built to a customer’s specifications.

“We’re offering a fully custom boat at an entry level price. I cannot emphasize how important that is. We want to be able to sell boats to cops and firefighters,” said Garcia, who has a 26TE at the Miami Boat Show. “It’s 110 percent your boat. You can have whatever hull color you want, you can have 150 rod-holders. We’re not a fly-by-night company. You’re not going to a company buying a red one or a blue one. Every boat is tailored to every individual.”

Chris Grillo, 26, is the CEO, owner and president of Angler Pro Boats and says he was “born and raised” in the boating industry. His father, Elio, owned Angler Boats, which Grillo says made the No. 1-selling 20-foot boat in the world. The elder Grillo sold the company to foreign investors about six years ago, but it folded, so his son, who studied business at St. Thomas University, bought the Angler molds and started his own company in 2016 with a commitment to excellence and value.

The boats, which are sold through dealers, come in five models ranging from a 17-foot flats boat to a 28-foot center console. All the boats are made using new lamination schedules that Grillo says make them stronger and lighter.

“I restructured everything from the ground up,” Grillo said. “The way we laminate the boats, the quality of the fiberglass, the quality of the resin. Other companies are going to put in the $20 bilge pump, we’re going to put in the $60 bilge pump. I’m going to put in the extra $40 to make sure that boat’s going to last you a lifetime. For me, I don’t have to make a killing. I don’t have to be a billionaire. We’re building a very high-quality custom boat for an affordable price.”

Miami International Boat Show

The Progressive Miami International Boat Show features 1,400 boats on land and in the water and more than 1,100 exhibitors.

When: Feb. 15-19 from 10 a.m.-6 p.m. each day.

Where: Miami Marine Stadium Park & Basin on Virginia Key, 3501 Rickenbacker Causeway, Miami.

Boats: Powerboats include cruisers, trawlers, center consoles, bay boats, flats skiffs and inflatables. Strictly Sail Miami, which had been held at the Miamarina at Bayside, is at Miami Marine Stadium with more than 50 sailboats in the water, plus sailing-related booths on land.

Admission: Premier Day, which is Feb. 15, costs $40. Thereafter, adult tickets for ages 13 and older are $25. A two-day pass, good from Feb. 16-19, is $45 and a five-day pass is $100. Children 12 and younger are free when accompanied by a paid adult. There are group discounts for 15 or more people. Purchase tickets online at www.miamiboatshow.com/admission#/select.

Parking: Parking can be purchased online at www.miamiboatshow.com/public-transportation. Parking is $35 and $50 at lots on Virginia Key, with free shuttle bus service to and from the show from 9 a.m.-7 p.m. Parking is $25 at AmericanAirlines Arena at 601 Biscayne Boulevard, with free shuttle bus service from 9 a.m.-7 p.m. Free water taxi service to and from the show is 9 a.m.-7 p.m. from AA Arena and Bayfront Park, 100 Chopin Plaza. There is no show parking at Marlins Park this year.

Economic Benefit: A 2017 study by Thomas J. Murray & Associates, Inc., in conjunction with the University of Florida, showed that the Miami Boat Show has an annual economic impact of $854.2 million, which is more than twice what a Super Bowl generates. That impact includes approximately $350 in sales of marine products at the show.

Information: Visit www.miamiboatshow.com, call 954-441-3220 or email info@miamiboatshow.com

Miami Yacht Show

The Miami Yacht Show features more than 500 boats and yachts on display in the water.

When: Feb. 15-19 from 10 a.m.-6 p.m. (10 a.m.-5 p.m. Feb. 19).

Where: On the Indian Creek Waterway along Collins Avenue between 41st and 54th Streets in Miami Beach.

Boats: Powerboats include motoryachts, superyachts (100 feet and longer), cruisers and sportfishermen.

Admission: Adults $25, children 15 and younger free. Purchase tickets online at www.miamiyachtshow.com.

Parking: General parking is $15 at the 17th Street Garage at 599 17th Street and $30 at the 67th Street Garage at 6625 Indian Creek Drive. Free shuttle bus service to and from the garages and the show is 9 a.m.-7 p.m. Free water taxi service is available from the Water Taxi docks at 65th Street and 24th Street. Valet parking is $60 a day from Feb. 15-18 at 4601 Collins Ave. and can be purchased at www.miamiyachtshow.com.

Information: Visit www.miamiyachtshow.com, call 954-764-7642 or email marketing@showmanagement.com.

Angler Pro Boats

The relatively new Angler Pro Boats uses the proven molds of the former Angler Boats company with the newest boat-building technology in fiberglass, resin and lamination schedules to build a flats boat, a bay boat and three offshore models. In the works are a catamaran and a boat for a jet-drive engine. Angler, however, will not be in the boat show this year.

Founded: 2016 in Hialeah

Run By: CEO, owner and president Chris Grillo

Location: 2337 NW 149th St., Opa-locka, a 14,000-square-foot facility.

Employees: Eight to 15, depending on how many boats are under construction.

Sales: Grillo started the business in 2016, began manufacturing boats in 2017 and sold 15-20 of them through the company’s dealer network. He expects to build and sell nearly 100 boats in 2018.

Most popular models: Angler Pro’s boats range from a 17-foot flats skiff that sells for $29,995 to a 20-footer with a T-top, a 150-horsepower Yamaha outboard motor and a trailer for $39,995 to an “almost fully loaded” 28-foot center console with twin Yamaha 300s that retails for $140,000.

Telephone: 305-525-4943

Website: www.anglerproboats.com

Seahunter Boats

SeaHunter is formally introducing its new Floridian 28 at the Miami Boat Show. Since word got out about the 28-foot, 5-inch boat, which is designed to fish inshore and offshore, the company can’t build them fast enough. “It’s something we’re really pushing,” marketing director Isabel Rubio said. “We’re actually on back order right now.”

Founded: 2002 in Princeton

Run By: President Ralph Montalvo

Location: 25545 SW 140th Ave., Princeton. Boats are built in a 46,000-square-foot building and there’s also a 20,000-square-foot facility that houses the engineering and service departments. Last year the company purchased what is now called SeaHunter Marina at Manatee Bay, a full-service marina in Key Largo for SeaHunter owners.

Employees: About 115

Sales: Around 50 new boats and 150 pre-owned boats sold in 2017

Most Popular Models: SeaHunter makes boats from 28 feet to 45 feet. Prices range from $180,000 for a nicely rigged 28 Floridian to $750,000 for a 45-footer with four outboards, a tower, a Seakeeper anti-roll gyro and other accessories.

Telephone: 305-257-3344

Website: www.seahunterboats.com

Contender Boars

Contender has its upgraded 35- and 39-foot center console models at the Miami Boat Show. The 35 has a new cap — the upper part of a boat that is attached to the hull — which has a more rounded design than the old 35. “It’s basically an aesthetic improvement to modernize the boat,” director of marketing Jordan DeLong said. “The 39 will have a brand new console.”

Founded: 1984 in Miami, began building a factory in Homestead in 1994 and moved there in 1997.

Run By: President and owner Joe Neber.

Location: 1820 SE 38th Ave. in Homestead.

Employees: 250

Sales: Approximately 300 boats built annually. “We put a fairly large number of boats out for the size of our facility,” DeLong said. “It’s a very efficient process.”

Most Popular Models: Contender models range from 22 feet to 39 feet. Prices range from about $75,000 to more than $500,000.

Telephone: 305-230-1600

Website: www.contenderboats.com

Dusky Marine

The Dania Beach company constantly upgrades its models with new innovations, such as joysticks that allow a boat to be moved sideways, which makes for easy docking, and bigger consoles to accommodate 16-inch screens for chartplotters, depthfinders and other electronics.

Founded: 1967

Run By: President Ralph Brown and vice president Michael Brown.

Location: 110 North Bryan Rd., Dania Beach. In addition to a manufacturing facility, the site has the Dusky Sport Center, which sells marine supplies ranging from anchors and fishing tackle to aluminum boats and outboard motors.

Employees: 49

Sales: Around 60 boats sold annually

Most Popular Models: Dusky models range from a 16-foot flats boat to a 33-foot center console. Dusky’s top seller is its 27-foot, 8-inch 278 model. Prices range from $30,000 to $250,000, depending on the options and accessories.

Telephone: 954-922-8890

Website: www.dusky.com

Cigarette Racing Team

The company has its new 42-foot GTO Reserve at the Miami Boat Show that features a 12-foot beam and four 400-horsepower outboard motors. Also at the show is Cigarette’s GTR Reserve.

Founded: 1969 in Miami

Run By: CEO Skip Braver

Location: 4355 NW 128th St., Opa-locka.

Employees: About 75

Sales: Not provided

Most Popular Models: Cigarette makes models from 38 to 50 feet. Prices range from $400,000 to over $1 million, depending on the model.

Telephone: 305-931-4564

Website: www.cigaretteracing.com

Streamline Boats

The company, which is less than a year old, sells one-off custom boats direct to the public. It will have a 26-foot tournament edition center console at the Miami Boat Show. Streamline is building a 34-foot center console that should be available by late spring or early summer.

Founded: 2017 in Opa-locka

Run By: Owners Lazaro Hernandez, Luis Blanco and vice president and manager Pedro “Pete” Garcia.

Location: The company is moving from a 3,000-square-foot facility in Opa-locka to a new 20,000-square-foot factory in North Miami.

Employees: 10

Sales: So far, Streamline has built six boats, which Garcia said has the company ahead of schedule.

Most popular models: Streamline currently offers a 26-foot tournament edition center console and a 26 sport model. Depending on the options, prices range from $85,000 to $126,000.

Telephone: 305-394- 4480

Website: www.streamlineboat.com is currently being updated, so check out @streamline_boats on Instagram.

Source: Miami Herald