South Florida’s industrial sector has retreated from roaring pandemic-era activity, but a burst of year-end transactions signal that investors continue to see opportunities in the region.

Buyers spent $215M across three transactions in Miami during the last two weeks of 2023, capping off a fourth quarter that also saw the year’s largest portfolio deal. The flurry of sales came as rents continued to tick upward despite a wave of new deliveries and a steep decline in annual leasing activity.

The market is returning to a pre-pandemic pace of activity, brokers say, but tight supply dynamics still favor landlords as migration trends continue to boost demand.

“We were kind of on a sugar high with the amount of activity that was going on” in 2021 and 2022, said Christopher Thomson, vice chair at Cushman & Wakefield. “It was almost double what normal activity is, but what I am seeing today is a consistent market of tenants that are looking at spaces.”

Miami-Dade County closed 2023 with 7.8M SF of annual leasing activity, a 21.6% decline from the prior year, according to preliminary data from Cushman & Wakefield. As leasing slowed, the region also saw 3M SF of new inventory come online and a further 7M SF under construction.

Rental rates continued their upward climb in Q4 despite the influx of new supply, albeit at a much slower rate than the double-digit increases seen in the prior two years. Average rents in Miami rose 3.8% year-over-year to $15.68 per SF, as vacancy climbed modestly by 0.8% but remained tight at 2.4%.

Iberia Foods recently signed a 398K SF lease at an under construction warehouse at Bridge Point Commerce Center (PHOTO: Google Maps)

One of the largest new leases of the year came in the last weeks of 2023 with Iberia Foods inking a 398K SF deal at Bridge Point Commerce Center in Miami Gardens, according to CoStar. The seller and distributor of Caribbean and Latino cuisine will move into an 800K SF building at the business park, one of two warehouses under construction at the Bridge Industrial development that are expected to deliver soon.

Iberia Foods’ large lease runs counter to the trend in South Florida. New deals between 20K and 50K SF accounted for 36% of leasing activity through Q3, and the number of deals above 100K SF slipped by 71.5%, according to Avison Young.

“We saw a softness in the market on the tenants above 100K SF having real trouble making decisions,” Thomson said. “It was less to do with the microeconomics down here in South Florida and more to do with the macroeconomics of the U.S. Those dynamics are beginning to shift as the prevailing consensus that interest rates have peaked is making tenants more willing to move ahead with large investments.”

Thomson added that his team was working on several larger-footprint deals that he expected to close in the first quarter.

The expectation that a backlog of demand and a runway for growth persists in Miami was reflected in a spate of year-end acquisitions. The largest of the deals to close in the last two weeks of December was the $174M sale of a Hialeah industrial park. Codina Partners sold three parcels in Beacon Logistics Park to an affiliate of Property Reserve, the investment arm of the Church of Jesus Christ of Latter-day Saints, South Florida Business Journal reported.

Codina broke ground on the warehouse park in 2018 and has completed two buildings on the property’s 63 acres, with another two under construction. Another pair of buildings are permitted for development but haven’t broken ground. The property has approvals for up to 1.5M SF of space.

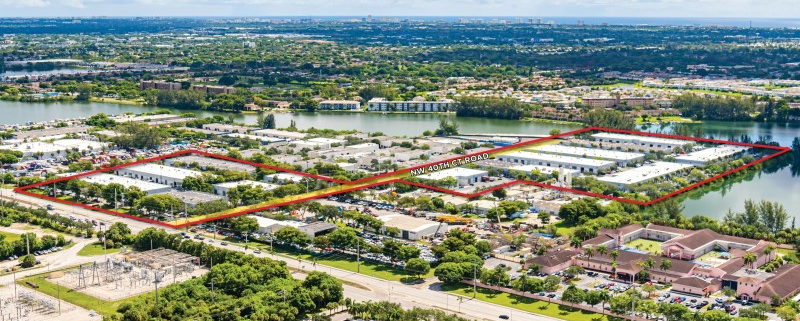

New Jersey-based industrial investment firm Faropoint acquired another industrial portfolio at the close of the year, spending $25M on three warehouses totaling 142K SF at 12900 NW 38th Ave. in Opa-Locka, The Real Deal reported. The seller, California-based industrial investor The O’Donnell Group, paid $17M a year earlier to acquire the properties.

On the single-tenant side, The Easton Group paid $17M for a 45K SF warehouse in Medley in a deal that closed Dec. 20. The seller was the snack company Frito-Lay, a subsidiary of PepsiCo, which will be relocating to 131K SF at Bridge Point Doral in what was the largest new lease of Q3.

Doral-based Easton was one of several bidders on the property, said Dalton Easton, an associate at the firm’s brokerage arm, Easton & Associates, who arranged the sale. Easton secured $9M in financing for the deal from Grove Bank and Trust in just three weeks, despite not having a new tenant in place and what Easton described as a challenging lending environment.

“Miami’s bread and butter tenant size is 50K SF and lower,” Easton said. “You’re seeing more normalized demand, you’re not seeing 15 or 20 users looking for half a million SF, you’re looking at the usual 50K SF and smaller.”

As part of a 25-building portfolio that sold for $260M, Longpoint Partners acquired the buildings at 2100 and 2190 SW 71st Terrace in Davie (Courtesy of Images For Business)

The deals followed a 25-building transaction earlier in the month in which Longpoint Partners paid $260M to acquire a 1.4M SF portfolio from Pennsylvania-based Seagis Property Group, Commercial Observer reported.

After acquiring the portfolio, which spans Miami-Dade and Broward Counties and is 97% leased to 77 tenants, the Boston-based private equity firm secured a $94M construction loan covering nine of the properties, South Florida Business Journal reported. The loan came from Athene Annuity and Life Co., a subsidiary of Apollo Global Management.

The performance of the industrial sector in Broward County in 2023 mirrored, and in some respects outperformed, its neighbor to the south.

The county saw 2.8M SF of leasing activity through the year, a 43% dip from 2022 levels, according to Cushman & Wakefield’s preliminary data. But a significantly smaller number of deliveries, which totaled 693K SF with 618K SF currently under construction, helped push vacancy down half a percentage point year-over-year to 2.7%.

“The tight market helped Broward County maintain double-digit annual rent growth, with average rents rising 12.1% year-over-year to $15.37 per SF,” Thomson said. “But the pace of rate increases is expected to slow in 2024 as the market returns to a level of leasing activity more in line with pre-pandemic levels. If you look at the rental rates in comparison to where they were in 2019, there has been such a run-up that I think we’re just going to really see them go back to a natural 4% increase going forward. When you talk to people that are looking at projects to purchase, they’re not budgeting 10% to 20% rental increases.”

Rockpoint paid $180M for 88 acres in Pompano Beach where it’s planning to build 1.5M SF of industrial space (PHOTO CREDIT: Rockpoint)

The dynamics are fueling some speculative development, with Rockpoint paying $180M in November for an 88-acre development site in Pompano Beach. The Boston-based private equity firm is planning to build around 1.5M SF of industrial space at the site, with the first phase slated to break ground in May.

“We are excited about this opportunity given the attractiveness of our basis combined with significant rent growth that Broward County is experiencing,” Tom Gilbane, managing member at Rockpoint, said in a statement following the acquisition.

The burst of activity in Q4 is likely to carry into this year, industrial brokers said, with any interest rate cuts at the Federal Reserve unlocking capital for acquisitions in the supply-constrained South Florida markets, which CoStar predicts will be among the top U.S. regions for rent growth over the next four years.

“If the Fed starts cutting rates, the cost of capital will follow and it’ll create a surge of activity,” Easton said. “From an acquisition standpoint, across the board, there has been capital on the sidelines waiting to be deployed down here for a long time.”

Source: Bisnow