U.S. commercial real estate is a likely winner in the evolving Republican tax overhaul, which is poised to lower rates for property owners, spur new investment and increase demand for rental housing, according to a new report.

Owners and developers of commercial real estate stand to gain from a new tax break for “pass-through” entities, which don’t pay corporate tax but instead pass income through to their owners’ individual tax returns, according to the report, by Cushman & Wakefield Inc. The House and Senate have reached a tentative agreement to create a 20 percent deduction for pass-throughs, which the report notes are responsible for 61 percent of investment in U.S. commercial real estate.

It’s not as big a boon for the industry as it might have been. The House bill passed last month slashed the top tax rate on pass-through income to 25 percent from a current top rate of 39.6 percent. That would have been a “huge win,” said Revathi Greenwood, head of Americas research for Cushman & Wakefield.

The Senate bill has tied the new deduction to the amount of wages the business pays, said Greenwood, meaning larger savings for ownership structures with more employees, such as real estate investment trusts. It’s unclear whether the House-Senate compromise retains that provision.

Representatives of the two chambers are meeting this week to reconcile their versions of the legislation, setting the stage for President Donald Trump, who made his fortune in commercial real estate, to sign a bill into law as early as next week.

In the weeks since the House of Representatives unveiled its tax plan, on Nov. 2, housing experts have warned of its potential effects on the U.S. housing market. Proposed changes to the treatment of mortgage interest and state and local taxes could reduce incentives for buying a new home. Potential effects on commercial real estate have gotten less attention, perhaps because the industry doesn’t have much to complain about.

Opportunity for Malls

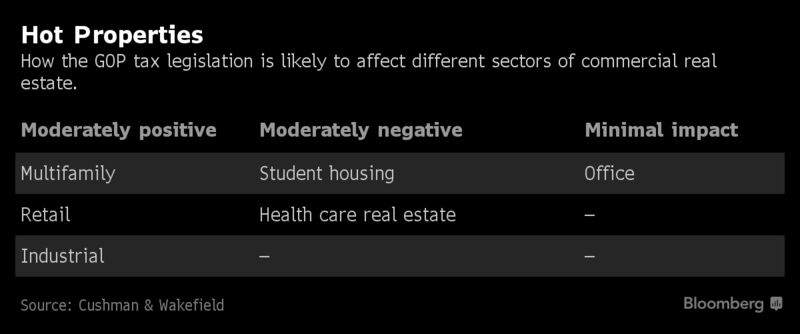

Still, not every sector will benefit equally. The tax plan should favor residential landlords, the report said, with the tax benefits of homeownership curbed. It is also likely to benefit retail landlords by lowering taxes on companies that rent space and leaving consumers with more discretionary income to spend.

“Mall operators are looking at restructuring anyway, remaking their properties to give shoppers experiences they can’t get online,” Greenwood said. “We think some of the money saved in taxes will be reinvested back into the business. Office landlords are likely to see more-modest gains. While corporate tenants are key beneficiaries of the tax plan, they’re likelier to return tax savings to shareholders than to increase spending. The tax overhaul could benefit the office sector by discouraging companies from moving their headquarters abroad to save on taxes. Health-care companies are likely to pare back investment in real estate.”

That’s partly because a Senate provision to repeal Obamacare’s individual mandate could curtail demand for services, and partly because both the Senate and House bills reduce exemptions for charitable gifts, which are often used to fund the construction of new hospital buildings.

Click here to view the Bloomberg news video ‘House, Senate, Said To Reach Tentative Tax Deal’

Source: Bloomberg